LAPO/PIND: GIVING HOPE TO FARMERS, TRADERS, OTHERS

Tejiri Ebikeme/Francis Sadhere

In the oil-rich Niger Delta region hunger is the order of the day despite the oil wealth. The people are struggling everyday to have food on the table. Things are so bad and hard in the region and this is why many organizations have taken it upon themselves to rescue the people from abject poverty.

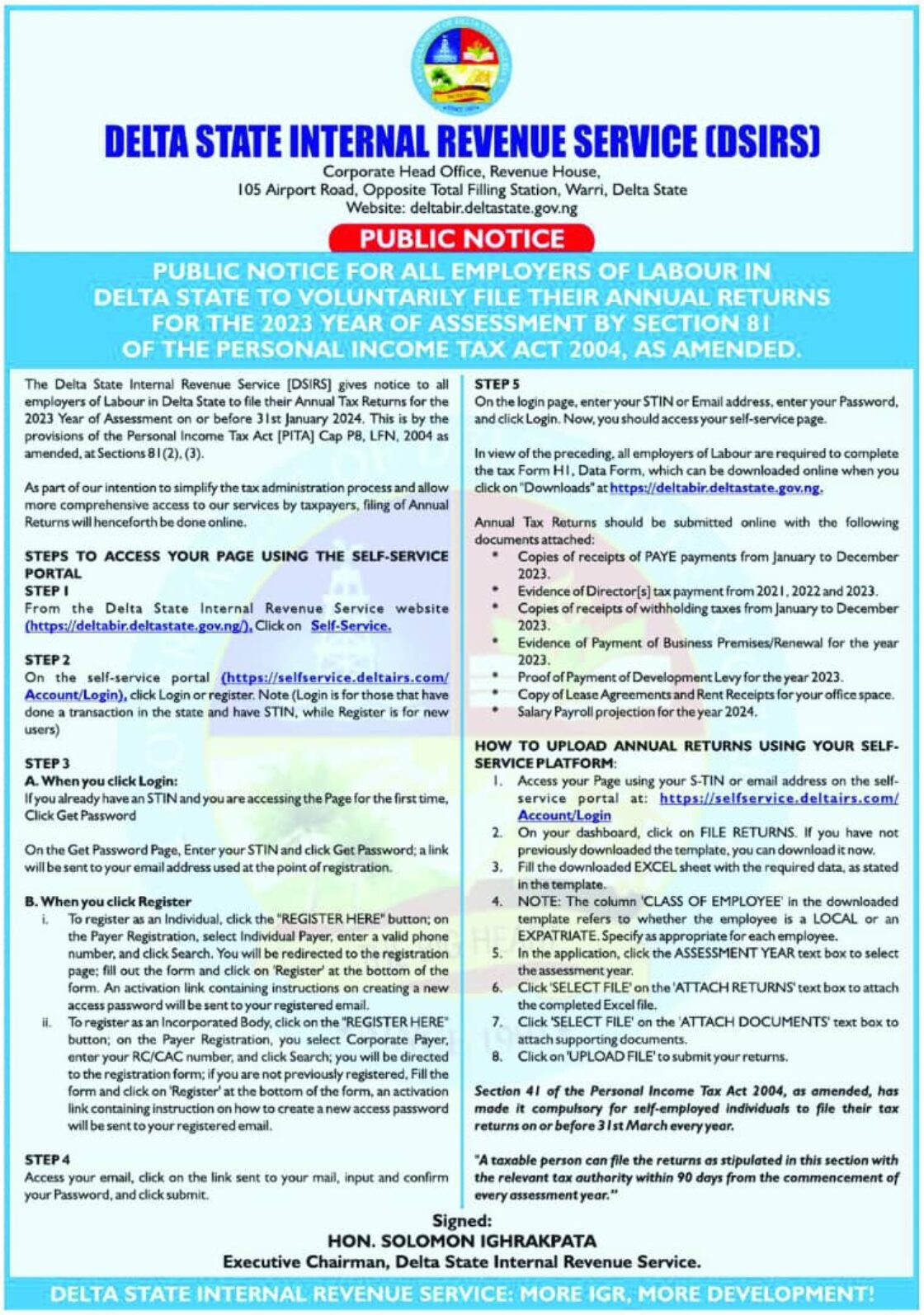

A cross section of journalists in a chart with LAPO staff in Benin City, Edo State during a recent media workshop/tour on Pro-Poor Income Growth and Employment Generation Model in Delta and Edo States organized by PIND.

At a recent media workshop/tour on Pro-Poor Income Growth and Employment Generation Model in Delta and Edo States organized by Foundation for Partnership Initiatives in the Niger Delta (PIND), journalists drawn from all parts of the country were excited about efforts being made by PIND and Lift Above Poverty Organization in Benin City, the Edo State Capital to give succour to the people.

Tessa Anota is the Manager, Planning, Monitoring and Evaluation of the Benin-based LAPO. She told visiting journalists at the Headquarters of LAPO that many farmers and traders in Niger Delta region have been aided over the years by LAPO and PIND.

“We have come to the rescue of many farmers and traders in the Niger Delta region over the years with loan and today the people are happy for it. We have brought sunshine upon their lives and we will continue to be there for the suffering masses.” Tessa Anota said.

Lift Above Poverty Organization (LAPO) is a pro-poor financial institution committed to the empowerment of low-income Nigerians through access to responsive micro credit funds. It deals with low income farmers and traders. It is also partnering with the Foundation for Partnership Initiative in the Niger Delta, PIND. LAPO has come out with a new lending innovation targeted at the poor. It has evolved a way of lending to the poor with a 2.2% interest rate payable at the convenient of the borrower.

Speaking to journalists during the media tour, the Programme Manager, Mr. Andrew Udah briefed journalists on the new strategy adopted by LAPO. He explained that LAPO, after much research, had found out that it was not easy for the ordinary poor man in the streets to have access to loans. And in places where he had access to loans, he cannot pay back because of the high interest rate charged by the conventional banks. So most times, the poor man continues to struggle without because he cannot access loans.

How is LAPO able to resolve this issue? According to Mr. Udah, LAPO, through its partnership with PIND and USAID, came up with a new innovation whereby farmers and traders are given loans and are allowed to pay back at their own convenience. How is this possible? Mr. Udah explained that since they know that farmers, for example, cannot pay back their loans unless they have harvested their crops. So what LAPO does is to link the farmers with markets where they can sell their produce. LAPO will then collect its money at the point of sale.

Explaining further, Mr. Udah said; “LAPO has found out the farmers, especially, would not be able to pay back their loans unless they harvest their produce. So what we do in LAPO is that we monitor the farmers by making sure that their farms are well taken care of. We go into research and provide the farmers with the necessary skills and materials need for them to improve their yield. What we do in LAPO is that we do not give physical cash. We provide all the materials like fertilizers, good seedlings, chemicals, etc, to the farmers and we monitor them. We also link them to market for their products. For example, here in Edo State, cassava farmers who take loans from us are linked to THAI Farms in Ososa Ondo State, who will buy the finished produce from the farmers.

Mr. Udah said that this innovation was the first of its kind in the country. He added that they have concluded plans to flag of the scheme and that very soon farmers in the country will begin to benefit from the scheme. He revealed that a Memorandum of Understanding was already being concluded with the Edo State Co-Operative Farmers Agency and that very soon the scheme will be flagged-off.

Mr. Andrew Udah and Tessa Anota noted that things are getting better for the people in the region courtesy of LAPO and PIND.

Boosting the demand of small-scale farmers’ produce is a major part of PIND’s work. Through engagement with the Lift Above Poverty Organization (LAPO), 13 communities were mobilized for cassava shipment to Thai Farms, reaching 95 farmers. With increasing knowledge of the economic benefit of cultivating cassava varieties with high starch content, several cassava farmers have requested for high yielding cassava varieties with high starch content. The organization is currently in talks with Edo State Government and Thai farms on a joint venture cassava out-grower scheme on a 3,000ha farm land with the approval of the Edo State Government.

Speaking to the President, Edo State Co-Operative Farmers Agency Limited, Mr. Amayo Nosa Confidence, said that; “all necessary arrangements for the flag-off of the scheme has been made. The MoU between LAPO and Edo State Co-Operative Farmers Agency Limited has being concluded and we are just waiting for the flag-off. LAPO has spoken extensively with us and have gone round to inspect our farms and they are satisfied that the scheme was going to work. They told us that they are just waiting for the state government to come and flag-off the scheme.”

LAPO Microfinance Bank provides a range of financial services which enable low-income households enhance their productive capacity, build and consolidate their economic base and manage risks. These products and services include loans, savings, micro-investment and micro-insurance.

Loans of various types and terms are provided to meet the varied and emerging needs of clients. Their loan products are suitable for farming, trading, consumption and acquisition of income generating assets.

It offers various types of savings products which support clients to build assets and equilibrate uneven cash-flows. There are regular savings and term-deposit products.

Micro-insurance services are offered in collaboration with a major insurance company. Policies include life, fire in the market place and hospitalization. There are plans to include a comprehensive health insurance services.

LAPO’s institutional structures, procedures and services have always been influenced by the following assumptions: Low-income people are too disadvantaged to benefit from credit schemes operated by formal financial institutions. The poor are not necessarily lazy. An improvement in the socio-economic situation of the poor will take place if financial services are added to support their physical labour and skills. Small groups have tremendous influence on cooperating individuals. Poverty is reinforced by problems such as too large family size, malnutrition, ignorance and disease. Poor women and children are relatively more neglected.

PIND is a Nigerian non-profit Foundation established in 2010 with initial funding by Chevron Corporation to support a portfolio of socio-economic development programs for Nigeria’s Niger Delta in order to improve standards of living of communities in the region. PIND supports projects in collaboration with a diverse range of donor partners including bilateral and multi-lateral aid agencies, federal and state government agencies in Nigeria, private companies and foundations. With an overarching goal of increasing income and employment in the region, the Foundation has four distinct but interrelated program areas, Economic Development, Capacity Building, Peace Building, and Advocacy and Analysis.